closed end credit def

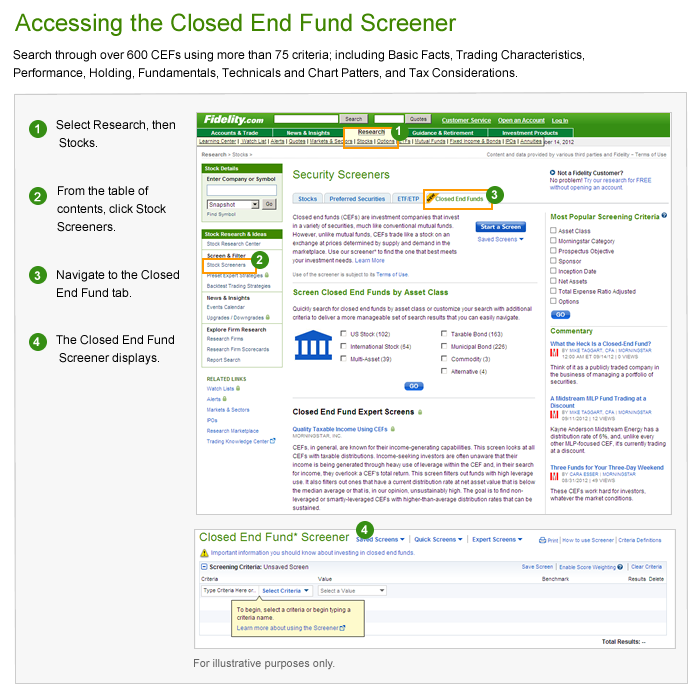

What does CLOSED-END CREDIT mean. From Wikipedia So if a stock drops irrationally the closed-end fund may snap up a bargain while open-ended funds might sell too early.

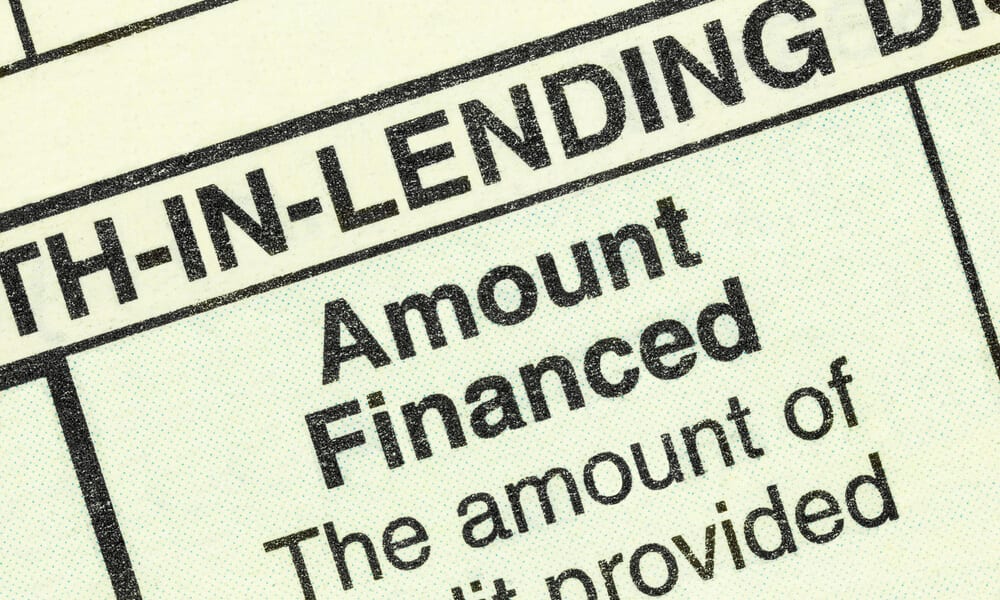

The credit is obtained for a particular purpose and the borrower is required to pay the entire loan including the interest and maintenance fees at the end of the set period.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

. A closed-end line of credit combines the features of a closed-end loan and a line of credit. Closed-end credit means an extension of credit to a consumer that is not open - end credit under paragraph a 16 of this section. The borrower must completely satisfy the terms of the loan in that period of time.

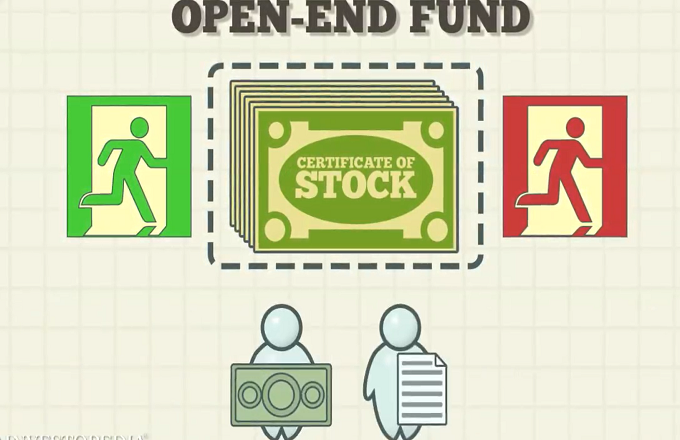

Issuing a fixed number of shares that can be traded publicly but are not redeemable by the issuer. Most real estate and. 1The creditor reasonably contemplates repeated transactions.

Official interpretation of 2 d Closed-end Mortgage Loan Show. A closed-end credit is defined as credit that must be repaid in full by the end of a fixed term. Close-End Credit A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date.

A closed-end fund is not a traditional mutual fund that is closed to new investors. Adjective having a fixed capitalization of shares that are traded on the market at prices determined by the operation of the law of supply and demand compare open-end. There is often confusion between an open-end credit and a closed one.

The repayment includes all the interests and financial charges agreed at the signing of the credit agreement. With closed end credit when you originally apply for a loan with the lender the terms never change. Closed-end credit can be found in various forms throughout the financial world.

Closed-end credits include all. Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date. Closed End Credit is defined 2262 as credit other than open-end credit.

BANKING AND CREDIT NEWS-March 18 2019-Duff Phelps declares. All are closed-end meaning the number of investors and amount of investment dollars are capped. In closed-end credit facility credit proceeds must be paid in full on closing credit arrangement.

As mentioned previously a closed-end loan is a highly regulated form of borrowing in which a lender offers a specific sum of money to a borrower that must be repaid within an agreed-upon timeframe. C Closed-end credit has the. With a closed-end loan you borrow a specific amount of money.

D Closed-end mortgage loan means an extension of credit that is secured by a lien on a dwelling and that is not an open-end line of credit under paragraph o of this section. At its most fundamental level a CEF is an investment structure not an asset class organized under the regulations of the Investment Company Act of 1940. Closed end credit is different because it doesnt allow you to continue using the same credit over and over.

For example in an automotive loan the lender might extend credit for five years. Full payment includes amount advanced interest and. Closed-end credit means consumer credit other than open -end credit as that term is defined in Regulation Z Truth in Lending 12 CFR part 226.

The loan amount interest rate and loan term are agreed upon and both you and the lender must adhere to these terms. Repayment includes the original amount of the loan plus all associated finance charges. Close-end credit An agreement in which advanced credit plus any finance charges are expected to be repaid in full over a definite time.

And 3The amount of credit extended during the term of the plan. Closed-end synonyms closed-end pronunciation closed-end translation English dictionary definition of closed-end. Closed-End Credit Law and Legal Definition A credit arrangement to be paid in full by a specified date is closed end credit.

A Adverse action has the same meaning as in 15 USC. A closed-end investment company. Open-end credit is defined as credit extended under a plan in which.

What is closed-end mortgage. Certain depository institutions originating fewer than 25 closed-end mortgage loans or fewer than 100 open-end lines of credit each year may no longer be subject to HMDAs reporting requirements at. 1681a k 1 A.

As monthly installments are made the balance owed to the lender decreases. Closed-end lines of credit are often used for home building. Once the closed end credit is paid off and.

These loans will generally have a fixed rate of interest attached to them although variable rates are possible and will require the borrower to pay back both. From Wikipedia In normal circumstances closed-end funds do not redeem their own shares. The closed-end equity loan allows a borrower to stick with a fixed interest rate which may provide additional peace of mind.

A closed-end loan restricts borrowers to a one-time payment of the amount borrowed but this type of loan will be the low-cost option to borrow against a homeowners home equity. To better understand open-end credit it helps to know what closed-end credit means. In a closed-end credit the amount borrowed is provided to the borrower upfront.

B Annual percentage rate has the same meaning as in 12 CFR 102614 b with respect to an open-end credit plan and as in 12 CFR 102622 with respect to closed-end credit. Definition of closed-end mortgage in the Financial Dictionary - by Free online English dictionary and encyclopedia. A Mortgage Loan is an Example of a Closed-End Credit.

CLOSED-END CREDIT meaning - CLOSED-END CREDIT definition. 2The creditor may impose a finance charge from time to time on an outstanding unpaid balance. A CEF is a type of investment company whose shares are traded on the open market like a stock or an ETF.

In contrast a closed-end credit is when one requests a lender to borrow a specific amount of money usually in a lump sum and paid up front and then one is required to repay the principal and interest according to a regular payment schedule set by the lender. For purposes of this subpart the following definitions apply.

The 5 24 Rule Opening Closing Credit Cards Can Backfire Forbes Advisor

How To Read Your Credit Card Statement Rbc Royal Bank

What Is The Meaning Of Closed Settled And Written Off In Your Credit Report

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Credit Scoring Fico Vantagescore Other Models

What Are Closed End Funds Fidelity

Revolving Credit Vs Line Of Credit What S The Difference

Truth In Lending Act Tila Consumer Rights Protections

/does-closing-a-bank-account-affect-credit-score-4159898-V2-45d9935c2796436a873c0ca8dbf3ab43.jpg)

How Closing A Bank Account Affects Your Credit Score

What Is Open End Credit Experian

Viral Tiktok Discovers The Batman S Hidden Post Credits Message Cinemablend

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Understanding Finance Charges For Closed End Credit

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

What Is A Closed End Fund And Should You Invest In One Nerdwallet

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

/GettyImages-1036166450-960fb3b85dea492a8044bdbd1395c367.jpg)